As our parents age, many of us face a role reversal where we begin to take responsibility for their well-being if we see our elderly parents financially irresponsible. While it’s never easy to step in, financial irresponsibility in elderly parents is a growing concern. Cognitive decline, medical expenses, and the complexity of modern financial systems can lead seniors to make poor financial decisions. In this article, we’ll explore the causes, warning signs, and strategies for managing elderly parents’ financial irresponsibility, offering practical steps and professional guidance.

*This post includes affiliate links, which means if you make a purchase through one of these links, I earn a small commission at no extra cost to you. This helps me keep providing high-quality content on this site for free. Rest assured, I only recommend products that I would personally use and believe will be helpful for my readers.

Managing Financially Irresponsible Elderly Parents: A Comprehensive Guide

As life expectancy continues to rise, more adult children find themselves managing their elderly parents’ finances for their aging parents. This responsibility can be daunting, especially when cognitive decline or poor financial management leads to issues like unpaid bills, mounting debt, or risky financial decisions. According to the Pew Research Center, senior citizens are living longer but may face difficulties managing their money due to medical conditions like Alzheimer’s disease, which affects memory and decision-making abilities.

This guide aims to help adult children recognize the warning signs of financial irresponsibility, address these concerns with compassion to during the difficult situation, and take practical steps to protect their parents’ financial well-being during these hard times. By understanding the root causes and implementing preventive measures, you can safeguard your elderly parents’ future while navigating the emotional and legal complexities of this role reversal.

Causes of Financial Irresponsibility in Elderly Parents

Cognitive Decline and Alzheimer’s Disease

One of the primary reasons elderly parents may struggle with managing their finances is cognitive decline. Alzheimer’s disease and other forms of dementia can severely impair memory and decision-making skills, making it difficult for seniors to handle financial matters effectively. The National Institute on Aging notes that Alzheimer’s affects one in nine people over the age of 65, and many experience difficulty remembering to pay bills or handle daily financial transactions.

Physical Illness and Declining Abilities

Physical health issues, such as arthritis, vision loss, or mobility challenges, can also affect a senior’s ability to manage finances. A parent dealing with chronic illness may be unable to review credit card statements, write checks, or visit financial institutions, making our elderly parents financially irresponsible. These limitations increase the risk of missed payments, which can lead to financial instability.

Poor Financial Decisions and Scams Targeting Seniors

Unfortunately, elderly people are prime targets for financial scams, just another bolt for our elderly parents financially irresponsible that are not quite their fault. According to the Federal Trade Commission (FTC), seniors are often tricked into risky financial transactions or investments. With cognitive decline and isolation, elderly parents may be more vulnerable to scams like fake investment advice, fraudulent home repairs, or phishing attempts. These scams can result in major financial losses that are difficult to recover.

Rising Medical Bills and Long-Term Care Costs

Medical expenses for elderly people can be overwhelming. With the cost of long-term care facilities, in-home care, and medical bills piling up, seniors may struggle to cover their expenses. Many elderly parents don’t have large savings accounts, relying instead on Social Security, small pensions, or help from their adult children. This financial strain can lead to poor financial decisions, such as depleting savings or taking on unnecessary debt.

Warning Signs Your Elderly Parent is Financially Irresponsible

If you suspect that your elderly parent is struggling to manage their finances, it’s crucial to recognize the warning signs. By paying close attention to financial behaviors, you can intervene before their situation worsens.

Unpaid Utility Bills and Overdue Medical Bills

One of the first red flags is a stack of unpaid utility or medical bills. If your parent has a history of paying bills on time but now struggles to keep up, this may indicate financial irresponsibility. Overdue payments can result in service interruptions or increased medical debt.

New or Unexplained Credit Card Statements

If your parent starts receiving new credit card statements or has unexplained transactions on their bank statements, it could signal risky financial behavior. Seniors may be tempted to use credit cards to cover expenses they can’t afford, which can quickly lead to debt.

Sudden Changes in Investment Decisions or Financial Transactions

Watch for any unusual changes in your parent’s investment advice or financial behavior. If they’ve made impulsive decisions, such as withdrawing large sums from a savings account or investing in unfamiliar stocks, it may be time to step in. Poor judgment, especially with large financial decisions, can be a sign of cognitive decline or external pressure.

Overdrafts and Depleted Savings

Regular overdraft fees, depleted savings accounts, or a failure to manage day-to-day finances are significant indicators of trouble. If your parent’s financial institution reports these issues or you notice them yourself, it’s essential to investigate further.

Steps to Address Financial Irresponsibility

Addressing your elderly parent’s financial irresponsibility requires tact, compassion, and a clear plan. Here are some effective steps to take:

Have Open and Respectful Conversations

It’s important to approach your parent about their financial issues with empathy and understanding. Start by discussing the challenges they’re facing and how you can help. Avoid sounding accusatory or overly controlling. Instead, emphasize that you’re concerned about their financial health and want to ensure their needs are met. Be prepared for resistance; many elderly parents find it difficult to relinquish control of their finances.

Legal Solutions: Power of Attorney and Revocable Trusts

If cognitive decline is a factor, you may need to establish legal tools like power of attorney or a revocable trust. A power of attorney allows you to manage your parent’s financial affairs if they’re unable to do so themselves. Similarly, a revocable trust can protect assets while giving you more control over financial decisions. Consult an elder law attorney to explore these options and determine the best course of action for your parent’s specific needs.

Setting Up Joint Accounts for Monitoring

One way to monitor your parent’s financial activities without fully taking over is to establish a joint account. This allows you to oversee transactions, pay bills, and intervene if necessary, all while respecting your parent’s autonomy. Be sure to set clear boundaries and maintain open communication about how the account will be used.

Working with Financial Institutions and Social Workers

Partnering with your parent’s financial institution can help protect against scams or poor financial decisions. Many banks offer services for seniors, such as automatic bill payments or fraud alerts. Additionally, social workers who specialize in elder care can provide support and guidance on managing finances.

Preventing Financial Irresponsibility

Taking preventive measures can safeguard your parent’s financial health and help avoid future problems. Here’s how you can prevent financial irresponsibility:

Early Discussions on Financial Affairs

The most effective way to prevent financial irresponsibility is to have early discussions with your parents about their finances. Sit down together to review their accounts, assets, and financial plans. This proactive approach allows you to identify any potential issues and address them before they become crises.

Set Clear Boundaries on Spending

Helping your parent set clear boundaries on spending is crucial, especially if they’re prone to impulse purchases or overspending. Encourage them to create a budget and stick to it. You can also use tools like online bill payment systems or set up financial alerts to track spending.

Utilize Technology for Financial Management

There are many tools available to help manage elderly parents’ finances, such as automatic bill payments, budgeting apps, and fraud detection software. These tools can minimize the risk of missed payments, overdrafts, or scams when our elderly parents financially irresponsible.

13 Practical Tips To Manage Elderly Parents Financially Irresponsible

Managing elderly parents’ finances can be a challenging and delicate process, but with the right approach, you can help safeguard their financial well-being while maintaining peace within the family. Here are 13 practical tips to help you navigate this responsibility effectively:

1. Have Open Conversations Early

Initiate discussions about your parents’ finances before a crisis occurs. This proactive approach helps you understand their financial situation and preferences, so you can offer support when the time comes. Be patient and compassionate, recognizing that talking about money can be uncomfortable for your parents.

2. Create a Financial Overview

Gather essential information about your parents’ financial assets, liabilities, income sources, and expenses. This should include bank accounts, insurance policies, investments, pensions, Social Security benefits, and any debts. Having a clear overview will make it easier to assist with budgeting, bill payments, and managing investments.

3. Organize Important Documents

Ensure that all important documents are easily accessible and organized. These should include wills, powers of attorney, health care directives, and financial account details. Make copies and store them securely, either in a safe or a digital vault.

4. Obtain Power of Attorney (POA)

A Power of Attorney is a legal document that allows you to make financial decisions on behalf of your parents if they are no longer able to do so. Without a POA, you may face legal hurdles when trying to access bank accounts or manage investments. It’s best to have this set up while your parents are still mentally competent.

5. Simplify Financial Accounts

Help your parents consolidate multiple bank accounts or investment portfolios into fewer, more manageable accounts. This reduces confusion and makes it easier to monitor their financial activities. Be sure to work with them to choose the accounts that offer the best terms and security.

6. Set Up Automatic Bill Payments

To ensure that bills are paid on time and prevent missed payments, set up automatic bill pay for recurring expenses such as utilities, mortgages, insurance premiums, and credit cards. This also helps reduce the cognitive load on your parents and ensures financial responsibilities are handled smoothly.

7. Monitor for Fraud and Scams

Elderly individuals are often targets of financial scams. Stay vigilant and monitor their accounts regularly for suspicious activities, such as unexpected withdrawals or unusual purchases. Encourage them to never share personal information over the phone or online unless they are certain of the recipient’s legitimacy. Consider signing up for fraud protection services or alerts from their financial institutions.

8. Create a Budget

Work with your parents to create a monthly budget that covers their living expenses, medical costs, and discretionary spending. Factor in any potential long-term care needs and ensure that they are living within their means. A well-structured budget can help prevent overspending and keep their finances stable.

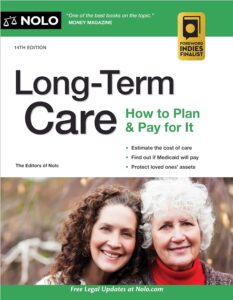

9. Look Into Long-Term Care Insurance

If your parents don’t already have it, consider purchasing long-term care insurance to help cover the cost of in-home care, assisted living, or nursing homes. This type of insurance can alleviate the financial burden of care in the later stages of life, preserving their savings and protecting your family from hefty medical bills.

10. Review Their Investment Portfolio

If your parents have investments, review them to ensure they align with their current financial goals and risk tolerance. As they age, their investment strategy may need to shift toward lower-risk, income-generating assets, such as bonds or dividend-paying stocks. Consult a financial advisor specializing in senior finances to help manage their portfolio.

11. Involve Other Family Members

To avoid misunderstandings or accusations of mishandling finances, keep other family members informed. Share regular updates about your parents’ financial situation and the decisions you are making on their behalf. This transparency can help prevent conflicts and ensure that everyone is on the same page.

12. Hire a Trusted Financial Advisor

Consider working with a financial advisor who specializes in elder care. A Certified Senior Advisor (CSA) or a fiduciary advisor can provide guidance on managing assets, estate planning, and navigating Medicare or Medicaid. Be sure to choose an advisor with a good reputation and a fiduciary obligation to act in your parents’ best interests.

13. Prepare for Estate Planning

Work with your parents and an estate planning attorney to ensure that their will, trust, and other estate planning documents are up to date. This helps ensure that their assets are distributed according to their wishes after they pass away. Estate planning also addresses other issues, such as designating guardianships, health care proxies, and charitable donations.

By following these practical tips, you can help ensure that your parents’ financial affairs are managed responsibly and efficiently, minimizing stress for both them and your family. Prioritizing clear communication, legal protections, and professional guidance will set you up for success in managing this challenging but crucial responsibility.

Managing Elderly Parents’ Finances: Addressing Family Concerns and Dealing with Conflict

Caring for elderly parents often involves stepping in to manage their financial affairs, especially if they are facing challenges like cognitive decline, rising medical expenses, or financial mismanagement. However, this responsibility can come with significant emotional strain, especially when other family members suspect you of taking advantage or your parents become angry about the situation. These concerns are common, but they can be addressed with empathy, clear communication, and the right support systems in place.

In this section of the blog, we’ll explore three important questions that often arise when adult children take on the responsibility of managing their parents’ finances: What if my family thinks I am taking advantage? How should I handle my parents if they are angry with me over this situation? And finally, Are there special financial advisors for the elderly that will not take advantage of the situation?

1. What if My Family Thinks I Am Taking Advantage?

When one family member steps up to manage an elderly parent’s finances, it’s not uncommon for other relatives to become suspicious, particularly if they are not directly involved in the day-to-day care. Financial decisions that you make for your parents, even with the best intentions, can be misinterpreted by other family members. Concerns about financial exploitation are valid, but they can lead to conflict and accusations of taking advantage of the situation.

Open and Transparent Communication

The best way to handle suspicions or accusations from family members is through open and transparent communication. Make sure to keep everyone informed about the steps you are taking to help your elderly parents. This could include sharing details of financial transactions, expenses, and any legal or financial professionals involved. Regular updates help to build trust and show that you are acting in the best interests of your parents.

Key Strategies:

- Document Everything: Maintain detailed records of financial decisions, including bills paid, investments made, and any changes in assets or income. These records can serve as evidence if questions arise about how funds are being managed.

- Hold Family Meetings: Schedule regular family meetings to discuss your parents’ financial situation and any decisions that need to be made. This creates a space for family members to voice their concerns and ask questions.

- Involve a Third Party: If tensions run high, consider involving a neutral third party, such as an elder law attorney or financial advisor, to mediate discussions. Their professional oversight can provide reassurance that everything is being handled properly and ethically.

Establishing Legal Protections

One way to protect yourself from accusations of exploitation is to ensure that legal protections are in place. For example, a power of attorney gives you the legal right to manage your parents’ finances, but it must be granted voluntarily by your parents and should be documented by a lawyer. Having this legal authority reassures family members that you are managing finances according to your parents’ wishes.

In some cases, setting up a revocable trust or involving multiple family members in financial oversight (for example, through a joint account) can further prevent misunderstandings. These steps ensure transparency and give other family members peace of mind that everything is above board.

2. How Should I Handle My Parents If They Are Angry With Me Over This Situation?

It’s natural for elderly parents to feel angry or frustrated when they realize that they may no longer be able to handle their own finances. The loss of independence can be distressing, and they may direct their frustration toward you, even though you are only trying to help. Navigating this emotional dynamic requires patience, empathy, and clear communication.

Acknowledge Their Feelings

Before anything else, it’s important to acknowledge your parents’ feelings. Understand that for many seniors, managing their finances is a sign of independence, and the realization that they need help can feel like a loss of control. Validate their concerns by saying things like, “I know this is difficult for you,” or “I understand this is frustrating.”

Try to approach the conversation with compassion and avoid being defensive. By acknowledging their feelings, you create space for a more productive dialogue.

Emphasize the Benefits

Help your parents understand that your involvement is intended to protect them from potential financial pitfalls, such as scams, missed bills, or poor investments. Explain how managing their finances allows you to ensure their needs are met, their bills are paid on time, and their savings are protected. Emphasizing that this is a partnership—rather than a takeover—can help alleviate feelings of powerlessness.

Key Strategies:

- Frame it as Protection, Not Control: Instead of presenting the situation as you taking over, explain that you’re there to help ensure their financial security. Use phrases like “working together” or “team effort” to emphasize collaboration.

- Involve Them in Decisions: Whenever possible, involve your parents in decision-making, even if they need assistance. Let them maintain some sense of control by asking for their input on things like household expenses or financial goals.

Set Boundaries with Compassion

If your parents are angry or resistant to your involvement, it’s important to set boundaries without losing empathy. For example, if they refuse to allow you to help despite clear signs of financial mismanagement, you may need to gently but firmly explain the potential risks they face. If necessary, consult a professional—such as a social worker or elder law attorney—to provide guidance on how to balance their autonomy with their safety.

3. Are There Special Financial Advisors for the Elderly That Exist That Will Not Take Advantage of the Situation?

Yes, there are financial advisors who specialize in working with elderly clients and who understand the unique challenges they face. However, it’s essential to carefully vet any advisor you bring into the situation to ensure they will not take advantage of your parents.

Look for Certified Senior Advisors (CSAs)

One way to find a trustworthy financial advisor is by seeking out professionals who hold the Certified Senior Advisor (CSA) designation. CSAs are trained to address the financial, social, and health-related issues that seniors face. They are equipped to provide advice on a variety of financial matters, including estate planning, long-term care, and asset management.

Consider Fiduciary Advisors

Another important factor to look for is whether the financial advisor is a fiduciary. Fiduciaries are legally required to act in their client’s best interests, which reduces the risk of them taking advantage of the situation for their own financial gain. A fiduciary advisor is less likely to push unnecessary products or investments, focusing instead on what is best for your parents.

Ask the Right Questions

Before hiring a financial advisor for your elderly parents, it’s important to ask the right questions to ensure they are reputable and reliable. Some key questions include:

- Are you a fiduciary?

- Do you have experience working with elderly clients?

- Can you provide references or reviews from other senior clients?

- How are you compensated? (Ensure they are transparent about fees and commissions)

- What services do you offer in terms of long-term care planning or estate planning?

Additional Resources

You can also turn to elder law attorneys, social workers, or nonprofit organizations that focus on senior care to get recommendations for trusted financial advisors. The National Association of Personal Financial Advisors (NAPFA) and the Financial Planning Association (FPA) offer directories of fee-only advisors, which can help you find professionals who are committed to ethical financial practices.

Try this book for planning!

Professional Help & Resources

In-Home Care Providers and Financial Oversight

In-home care providers can assist with more than just physical care. They can help manage day-to-day tasks, including monitoring finances, paying bills, and alerting family members if they notice any financial irregularities when our elderly parents financially irresponsible. This type of support can be especially beneficial for parents with limited cognitive or physical abilities.

Elder Law Attorneys for Estate and Financial Planning

An elder law attorney can help you navigate the legal complexities of managing your parent’s finances. From setting up power of attorney to estate planning, an attorney can ensure that your parent’s financial affairs are in order and protected.

Government Agencies Offering Support

Several government agencies, including the Federal Trade Commission and the National Institute on Aging, provide resources and advice on senior financial management. They can offer guidance on protecting against scams, as well as information on long-term care and elder law.

Managing your elderly parent’s finances when our elderly parents financially irresponsible can be a delicate and emotionally charged process. However, by recognizing the warning signs, addressing issues early, and using the tools available to you—such as legal solutions and professional guidance—you can help protect your parent’s financial future. With open communication, respect, and a clear plan, you can navigate this challenging role reversal and ensure your parents’ financial well-being.

FAQ Section for Navigating Elderly Parents Irresponsible

- How can I tell if my elderly parent is struggling with finances?

- Look for warning signs such as unpaid bills, sudden financial decisions, or unexplained credit card charges.

- What legal steps can I take to manage my parent’s finances?

- Consider establishing power of attorney or a revocable trust. Consult an elder law attorney for advice on the best legal solutions.

- How do I discuss finances with an unwilling elderly parent?

- Approach the conversation with empathy. Emphasize that you want to help protect their financial well-being and ensure their needs are met.

- Are there services that help manage elderly people’s financial affairs?

- Yes, in-home care providers, elder law attorneys, and financial advisors specializing in senior finances can offer assistance.

- What are the warning signs of senior financial abuse?

- Look for sudden changes in financial behavior, unfamiliar people handling money, or unexplained withdrawals.